Key highlights:

- Smarter trade platforms will redefine trade finance and supply chains by enabling more accurate credit risk assessments, fraud detection, and real-time supply chain analytics, allowing businesses to make faster, data-driven decisions

- The US-China trade relations, the China Plus One and China Plus Two strategies, as well as the European Union’s Late Payment Regulation will push businesses worldwide to diversify their supply chains and reshape cross-border trade dynamics

- ESG will be an area to watch out for, with the demand for sustainable value chains caught between stricter ESG regulations and possible anti-ESG stance of the incoming US administration – however, businesses could possibly focus on responsible sourcing and carbon emission reduction

2024 started with significant challenges and shifts in trade and supply chain finance. High interest rates and persistent inflation ruled a large part of the year, with central banks worldwide tightening their grip on monetary policies to stabilise economies. Political tensions continued to plague the year – the conflict between Ukraine and Russia left a group of in-between European countries more insecure than before. Tensions heightened between the US and China over trade policies and technological domination. Strategic influence in the Indo-Pacific region further disrupted supply chains in the already fragmented global trade. The uncertainties in trade dynamics exacerbated supply chain disruptions, putting a great deal of pressure on corporations and CFOs to reassess their cost control, cash flow, and operational strategies.

Resilience through digitalisation, sustainability, and alternative financing in 2024

The crystal ball may not have seen it coming but despite these challenges, 2024 was a strong year for investors marked by bullish market sentiment. The spotlight was on exploring digitalisation, sustainability, and risk management strategies for the potential they hold. Some businesses adopted innovative solutions to navigate market challenges. Digitalisation, being in its early stages, saw a few large corporations like IBM and Maersk lead exploratory efforts with artificial intelligence (AI), intelligent analytics, and blockchain technology for supply chain transparency. Tesla and Ørsted, among others, pursued sustainability through renewable energy investments.

Businesses across many markets also initiated a move to alternative financing (AF) frameworks for greater liquidity. The rapidly evolving AF market, including players such as PayPal Holdings Inc., Kabbage Funding from American Express, and AgFunder, among several others, saw their largest market in North America. AF was also popular across China, India, Indonesia, Japan, South Korea, and Australia, with methods like equity crowdfunding, peer-to-peer lending, invoice financing, and more, bypassing traditional banking and financing channels. AF enhanced business resiliency by providing greater liquidity and reducing reliance on more stringent, traditional finance channels.

Even as strategists remained cautious about potential turbulence, 2024 laid the groundwork for 2025 as we can expect some of the momentum of these trends to be accelerated this year.

Monetary ease and improved credit affordability expected in 2025

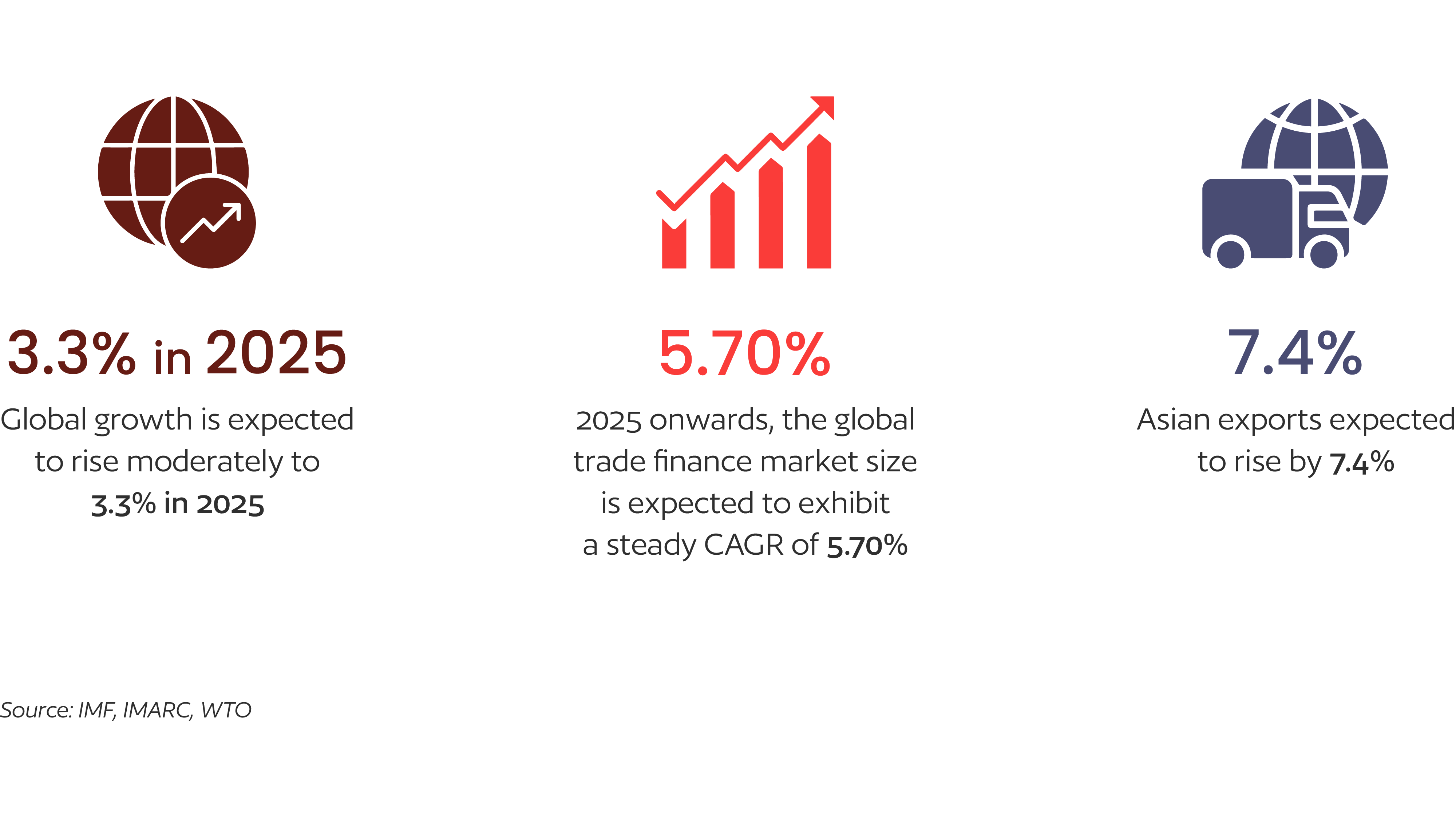

The Federal Reserve’s late-2024 lowering of interest rates is expected to follow into 2025, though not as fast as previously thought. As this sets the tone for gradual monetary easing globally, it should also make credit more affordable for businesses. Global growth is expected to rise moderately from 2.9% in 2024 to 3.3% in 2025, with trade volumes projected to increase by 3% globally and Asian exports rising by as much as 7.4%. It is predicted that the AF market will grow exponentially at a compound annual growth rate (CAGR) of 21.1% between 2025 and 2028. With the global economy emerging from a period of high interest rates, inflation, and trade disruptions, these numbers kindle hope of much-needed momentum in cross-border trade to boost exports and drive economic recovery.

Source: IMF, IMARC, WTO

Considering all these anticipated factors, it sets the stage for a transformative year focusing on the themes of innovation, balance and opportunity. Here are some key trends that will drive trade and supply chain finance in 2025:

AI-driven platforms will scale adoption, drive integration, and shape regulations

Up to 90% of the world depends on trade finance Bridging the gap between production and trade payment, digital trade finance will go smarter in 2025 with AI and blockchain technologies. While these advanced technologies may have seen limited adoption so far owing to staggering implementation costs as well as challenges from legacy integrations, 2025 could witness adoption at scale. For example, larger businesses such as Australia’s Coles supermarket chain and the CMA CGM Group from France have been leveraging AI for operations and supply chain analytics. Amazon, H&M, and UPS use AI for optimising routes, reducing waste, and improving supply chain responsiveness. However, in 2025, smart digital trade solutions are expected to penetrate even mid-sized and smaller businesses as these platforms show the potential to become more accessible.

Cross-platform integration, increased automation, and real-time transaction tracking will gain impetus. Low code and advanced AI will redefine the trade, banking, and finance ecosystems. In fact, low-code technologies are set to possibly triple this year, with up to 70% of new platforms expected to be developed using low code. AI-powered platforms that were focussed on operational improvements to credit risk assessment and supply chain analytics, are expected to see more strategic adoption of predictive AI this year. This could include supply chain finance optimisation, foreign exchange, supplier risk assessment, production planning, and predicting supply chain disruptions. Seamless integration will enable faster and more accurate decision-making across the value chain.

With more widespread digitalisation and AI-based solutions, there is expected to be a push for regulatory frameworks for interoperability standards in trade finance. The International Chamber of Commerce (ICC) is working on standardising the use of AI in trade, particularly in fraud detection and document verification. The initiative is expected to push for more responsible digital trade finance and supply chain practices this year, promoting greater cross-border interoperability. The Commodity Futures Trading Commission’s (CFTC) evaluation of the impact of AI on financial markets could also potentially lead to new regulations and guidelines in 2025.

Achieving balance with regional diversification

As geopolitical tensions continue to fuel instability, businesses will be forced to diversify their supply chains. This could be partly fuelled by the incoming US administration that is anticipated to implement new tariffs, including at least 10% on Chinese goods and 25% on products from Mexico and Canada. While it may lead to increased costs for Asian suppliers, it could also encourage them to diversify their markets and supply chains. Nearshoring to markets like India could gain some traction. As India prepares for trade negotiations with the US, aiming to increase exports and attract investments, it could open new opportunities for Asian suppliers to engage in US supply chains. Sectors such as semiconductors, electronics, and renewables could get a boost.

Meanwhile, China’s economy and stock market are projected to remain volatile due to ongoing trade tensions, uncertainty around the new US tariffs, and internal challenges. This instability may affect demand for Chinese manufacturers, leading to companies seeking alternative suppliers, further expanding their networks. China Plus One and China Plus Two could be the changing drivers towards diversification in 2025, reducing the global over-reliance on China.

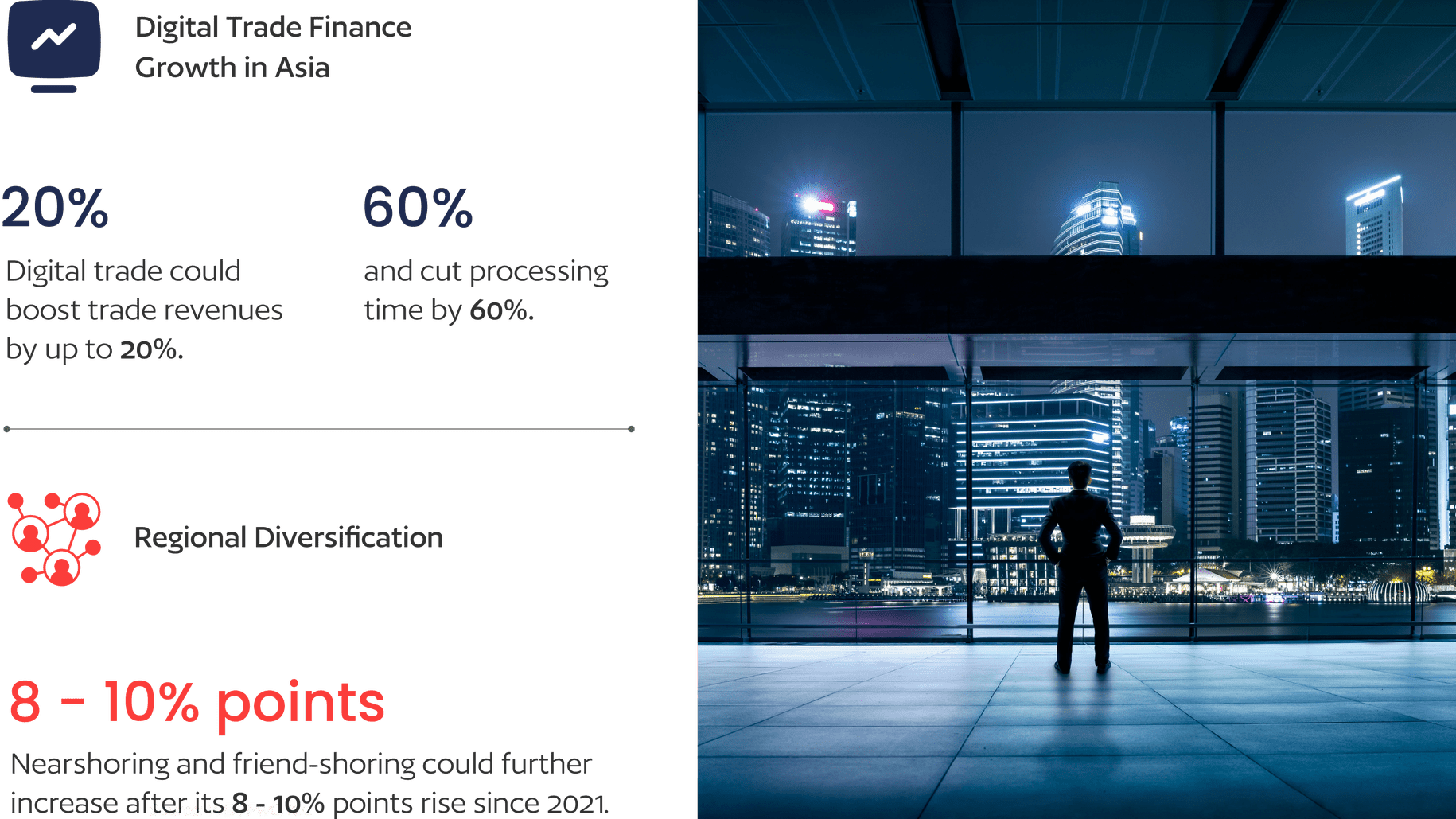

Besides reducing reliance on single-region suppliers, “re-globalisation” will enhance resilience against disruptions, open avenues to emerging markets, and increase adaptability to evolving trade policies and demand. We anticipate geographical reconfiguration and increased investment in Europe and the South-South trade corridors, particularly in Asia, Africa, and Latin America. Nearshoring and friend-shoring have increased by 8 and 10 percentage points in the last three years and will account for a significant share of supply chain restructurings in 2025.

Furthermore, the EU Late Payment Regulation, revised from its earlier 2011 directive and aimed at protecting micro, small, and medium-sized enterprises (MSMEs), has been strengthened. This revision could reshape cross-border trade dynamics with potentially greater demand for supply chain finance in Asia, along with global access to a more diverse production base.

Seizing opportunities by accelerating trade finance digitalisation especially in Asia

The global trade finance market size reached US $54.1 billion in 2024, and is expected to exhibit a steady compound annual growth rate of 5.70% 2025 onwards, largely driven by digital trade.

As the Model Law for Electronic Transferable Records (MLETRs) spreads its wings, the world will head closer to a digital trade economy. This translates to improved operational efficiencies, accurate data-led reporting, reduced manual effort, enhanced cash flow management, and greater fraud mitigation. Digital trade could boost trade revenues by up to 20% and cut processing time by 60%. Improved visibility across the supply chain and greater transparency in production will reap environmental benefits with more sustainable value chains.

Suppliers from Asia should consider adopting digital trade finance solutions for optimising working capital and enhancing cash flow visibility. Implementing robust receivables management systems can streamline compliance with evolving payment terms. Renegotiating contracts to include flexible payment structures and collaborating with financial institutions to secure affordable credit options will be crucial to maintaining liquidity and mitigating risks associated with shorter payment cycles.

The adoption of blockchain will gain momentum, addressing inefficiencies in cross-border transactions. The technology’s ability to track, verify, and automate financial transactions will help streamline compliance, increase transparency, and reduce risks. With banks in Singapore, China, Japan, Indonesia, Korea, Australia, and New Zealand having partially or completely adopted the Basel III framework, the EU has largely completed implementation. And while most APAC markets should be able to absorb the moderate increase in capital requirements, the move is likely to also spur innovation in digital trade finance, strengthening regulation, supervision, and risk management.

Watching the balance between green finance and globally varying ESG sentiments

Companies worldwide, including those in the US, maybe actively pursuing sustainability and carbon neutrality. However, environmental, social, and governance (ESG) compliance might not be a prominent trend for the year ahead given the incoming US administration’s stance on the critical issue. It is important to note that ESG is an evolving area to watch out for as we head closer to mid-century climate goals. While green financing could potentially expand with regulatory compatibility at the centre of over 2,400 ESG regulations worldwide, it could possibly see a downturn in the US and Britain.

In several parts of the world, green financing could also be caught between anti-ESG views and the pressure to meet stringent ESG requirements from the EU and other countries. the EU and other countries.

With stricter ESG regulations still in force globally, businesses could prioritise responsible sourcing and decarbonised supply chains. Partnering with sustainable suppliers, enterprises could achieve emission reductions of 10% to 30%, boosting ESG-compliant trade volumes. Microsoft, Siemens, bp, and IKEA are already making strides in resource usage optimisation, waste reduction, and emission monitoring and control across their value chains.

There may be a slowdown on passing newer ESG regulations this year, even as several others in waiting could potentially see adherence to reporting from 2025, including the Corporate Sustainability Reporting Directive (CSRD) for all public companies previously subject to the European Union’s (EU) Non-financial Reporting Directive (NFRD), and Australia’s Climate-Related Financial Disclosure Law, among many others.

Source: WEF, PwC, ICC

Following greater CFO involvement in ESG management, a shift towards integrating ESG into core financial and operational trade strategies could be a possibility to watch for. It will be interesting to see how ESG fintech companies apply generative AI (GenAI) to offer innovative sustainable financing solutions, balancing stringent ESG regulations on one side and growing anti-ESG sentiment in the West on the other.

Despite the potential for regulatory shifts, businesses would do well to continue to prioritise ESG standards in 2025 as climate consciousness remains a non-negotiable responsibility. It is also crucial for ensuring long-term sustainability, maintaining competitiveness, and securing investor confidence, especially as the global demand for responsible sourcing and decarbonised supply chains grows.

Fintechs can help build a resilient value chain and drive profits in 2025

2024 was a year of recalibration. By embracing the trends in digital trade innovation, balance in regional diversification and seizing cross-border opportunities, businesses can thrive in the changing global economy. Fintechs like TASConnect are already helping multinational corporations (MNCs) like Lenovo to lead this charge, offering smart tools and end-to-end working capital solutions that provide real-time visibility and predictive insights. What is the way forward in 2025? Leveraging trade finance solutions provided by these fintechs to build a resilient, future-proof value chain while driving profitable growth. Adopting these technology advancements can help your business thrive in the year ahead.