Your only platform that

simplifies trade finance profitably

all in one place.

We are a working capital and trade finance solutions platform that enhances cash flow visibility and optimises working capital for businesses. Our payables and receivables solutions drive sustainable growth, stability, and profitability.

As seen on

Do business better and smarter with value chain and trade finance solutions.

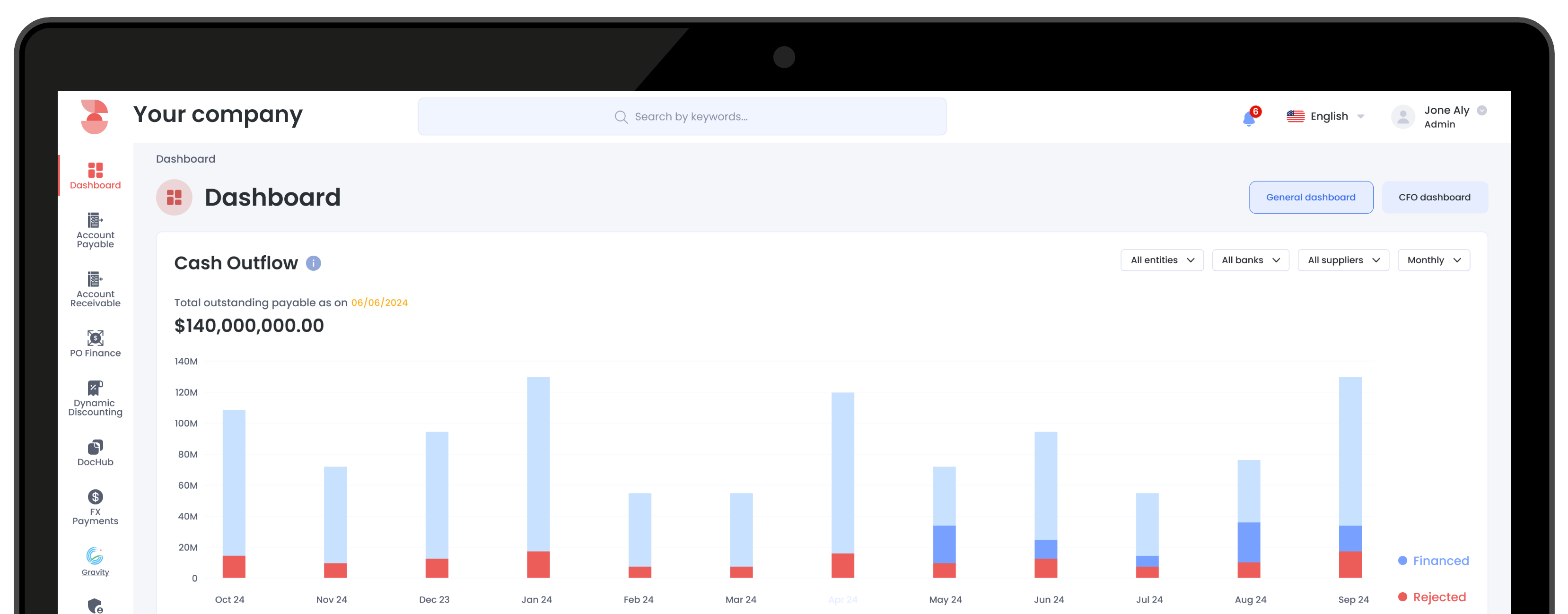

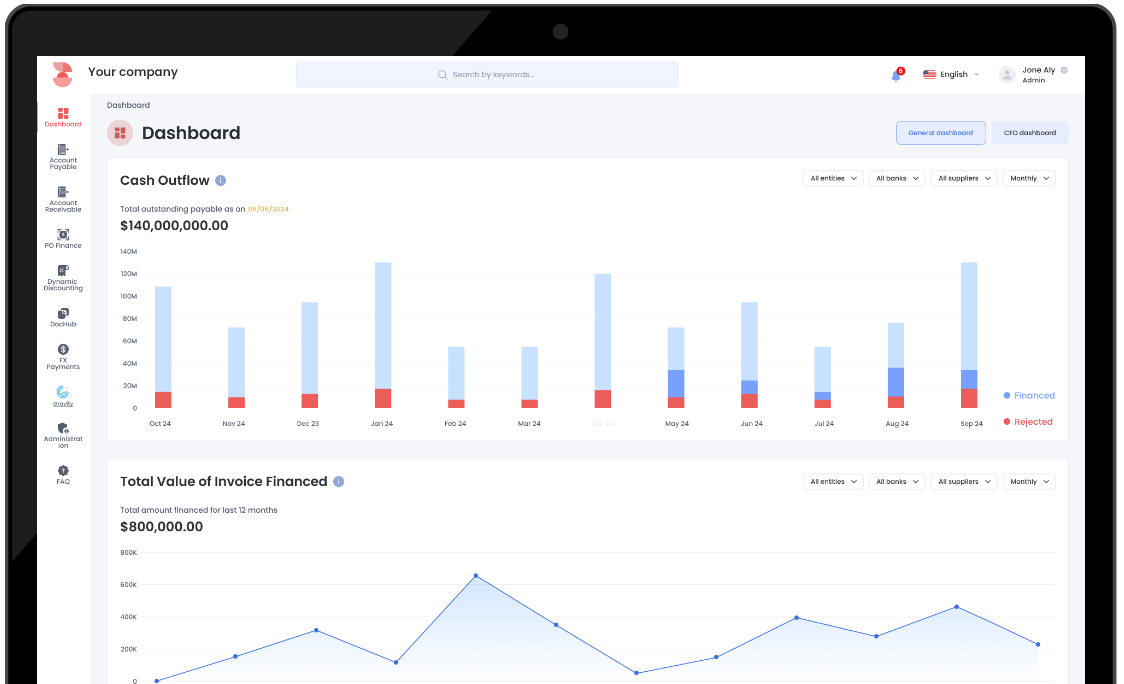

Our bank-agnostic platform offers end-to-end working capital and supply chain finance solutions that revolutionise financial operations, enhance cashflow visibility and ensure working capital optimisation.

All your ecosystem players connected at your fingertips

An end-to-end trade finance platform with a modular technology architecture

Payables Financing

Receivables Financing

Dynamic Discounting

Help your suppliers get early payments with our Supply Chain Finance solutions

Cross-border efficiency

Our Trade finance solutions reduce risks, accelerate global transactions and enhance cross-border efficiency

Trusted and secure trade finance platform

Award-winning platform trusted by Fortune companies and banks.

Hear from our clients.

“TASConnect has been a valuable partner in supporting our distributors with seamless access to competitive financing from leading financial institutions. By improving liquidity and providing essential working capital, our distributors can efficiently manage inventory, leverage bulk purchase incentives, and strengthen their relationship with Syngenta. This has enabled a more resilient and sustainable supply chain, benefiting both our distributors and our business.”

“Optimising the precision of supply chain management, balancing business expansion opportunities with risk management, and enhancing real-time insights into overseas markets and industry trends are all key considerations in our globalisation process. TASConnect, with its international perspective and customer-centric approach, has provided us with multi-dimensional insights, an effective data analytics framework, and customised service content that meets our complex needs across our sales, risk management, finance control, treasury and more functions.”

Yang Jinpei

Chief Financial Officer of YOFC

“TASConnect has provided us with a digitalised and ecosystem-driven cross-border supply chain finance platform along with professional and meticulous support at every stage, including demand analysis, solution design, internal alignment, and customized planning. We look forward to leveraging TASConnect’s global presence and expertise to co-create industry-leading, intelligent, and international supply chain solutions.”

Gao Minghui

Chairman of Protus Group

“TASConnect has been instrumental in our business growth, connecting us with multiple financing providers and government agencies to secure vital trade financing. Their one-stop platform simplifies access to financing limits, invoice tracking, and facility monitoring—freeing up resources for value creation.

We also extend our gratitude to Agrobank, recommended by TASConnect as the go-to bank for the agricultural sector. Initially skeptical, we soon realised Agrobank’s deep industry knowledge and unwavering support. TASConnect truly understands what growing SMEs need.”

Loh Jen Min

Finance Director

“TASConnect helped us transform & fully automate our previously manual supply chain finance processes. The platform is customised to integrate all our financing banks and replicate our own workflows. Our Treasury function is now empowered with end-to-end visibility and control, all via one single platform.”

Hugh Wu

Global Treasury Head, Lenovo

Tailored solutions, all in one place.

Smart trade finance can boost revenue by 20%

Read our 2025 Trends Report to learn about how the digitalisation of your supply chain can boost revenue by 20% and cut processing time by 60%. Don’t get left behind – see how other businesses are seizing opportunities with smarter platforms and processes