Financial Institutions

The financial institutions sector is experiencing rapid transformation driven by the need for digitalisation and scalable, efficient financial solutions. Banks and financial institutions are striving to enhance their working capital finance (WCF) programs, integrate advanced technologies, and comply with complex regulatory requirements. TASConnect, with its expertise in digital transformation and working capital finance, offers comprehensive solutions to these challenges.

Pain points

Scaling WCF Programs

Financial institutions face difficulties in scaling their WCF programs due to lengthy client acquisition processes and reliance on manual workflows.

Workflow Automation

Many banks lack fully automated workflows from corporate ERP systems to bank processes, leading to inefficiencies and increased operational costs.

Integration Challenges

Integrating and collaborating across multiple countries with third-party marketplaces and service providers remains a significant hurdle, often resulting in fragmented systems.

Credit and Analytics

There is often a lack of holistic value-chain analytics and real-time dashboards, which are essential for effective risk and business monitoring.

Front-End Platforms

Banks often do not have a unified front-end platform that interfaces seamlessly with corporates, suppliers, and distributors, complicating interactions and reducing efficiency.

Investment and Integration

High investment resources and time are required for digital integration and system enhancements, making it challenging to adapt quickly to market changes.

TASConnect Features and Advantages

Enhanced Cash Flow Management

TASConnect provides real-time tracking of payments and transactions, ensuring improved financial transparency and liquidity management across the financial ecosystem.

Workflow Automation

The platform automates workflows between corporate ERPs and bank systems, significantly reducing manual processes and enhancing operational efficiency.

Integration Solutions

TASConnect offers seamless integration with third-party marketplaces and service providers, facilitating global operations and improving connectivity.

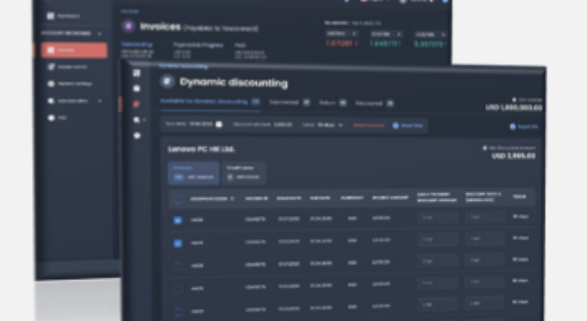

Advanced Analytics

The platform includes robust analytics and real-time dashboards, providing comprehensive risk and business monitoring to support informed decision-making.

Unified Front-End

TASConnect provides a common front-end platform that integrates with corporate and bank systems, streamlining interactions with suppliers and distributors and enhancing user experience.

Cost-Effective Integration

The platform enables quick, scalable, and cost-effective digital integration, reducing the need for extensive investment in new systems and allowing for faster deployment.

ESG Compliance

TASConnect supports accurate ESG reporting and offers ESG-linked finance solutions, helping institutions meet sustainability goals and regulatory requirements.