Tailored Solutions for Banks & NBFIs

Generate additional revenue by empowering your infrastructure

TASConnect offers financial institutions a scalable, cloud-based platform to enhance Working Capital Financing services, generate new revenue, and expand their client base. Our banking as a platform model integrates with corporate finance ecosystems, helping banks digitise financial operations with minimal disruption.

In addition, our invoice financing solution and early payment discounts, help clients of banks optimise cash flow while banks can offer financing solutions that strengthen client relationships.

Explore TASConnect Solutions

Acquire new clients, all in one platform

Gain access to TASConnect’s ecosystem of corporates and suppliers, attain better liquidity and manage risk with our treasury management software.

Expand reach and client acquisition

TASConnect ensures businesses have the working capital needed to cover daily operations, payroll, or supplier payments without interruptions. With reconciliation automation, financial institutions can ensure accurate payment processing, minimising errors and improving transaction efficiency.

Streamline processes and boost business flows

With faster access to funds, businesses can invest in new projects, take on larger orders, or expand without waiting for invoice payments.

Cost-effective scalability and integration

TASConnect’s cloud-based platform offers scalable solutions that grow with your business, reducing onboarding and integration costs with a universal adapter for seamless connection to your banking systems.

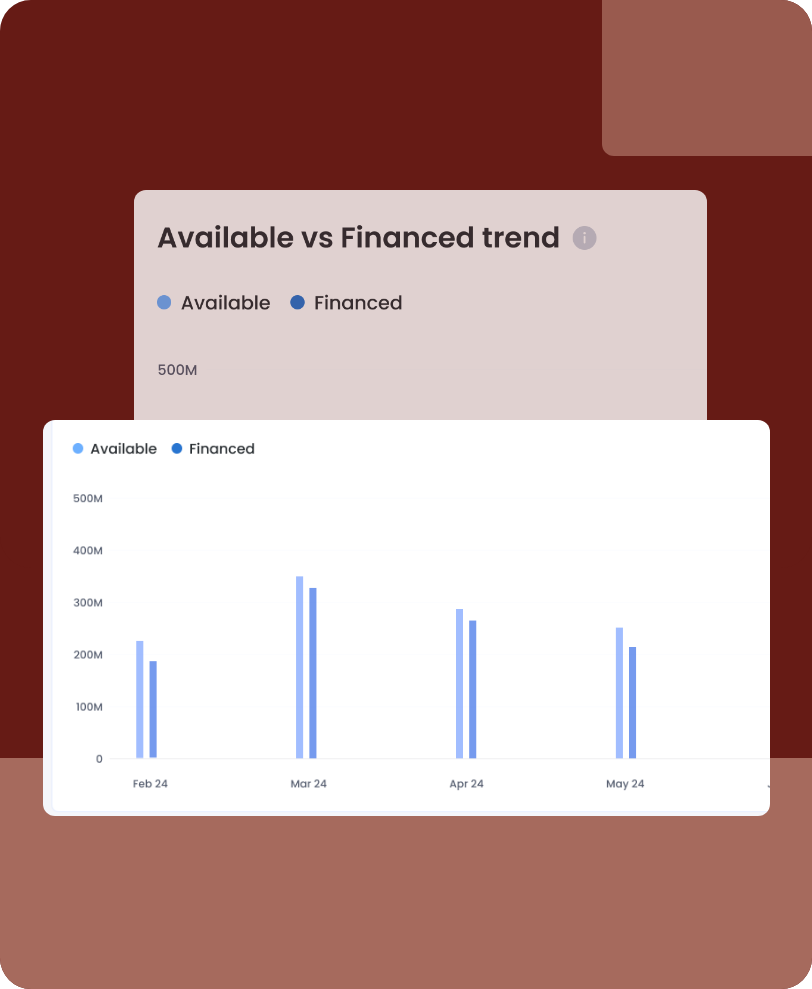

Unlock lending and cross-selling opportunities

Identify new lending opportunities within the working capital finance ecosystem, while encouraging existing clients to access a wider range of your financial services. Generate additional revenue through cross-selling while offering enhanced treasury management software capabilities for improved financial oversight.

White label your platform

We offer a fully customisable end-to-end seamless customer journey tailored to your financial institute’s colour and guidelines.

Minimise disruption and implementation costs with TASConnect’s universal adapter, which simplifies integration with your existing banking systems.

Say goodbye to inefficiencies, operational risks, and missed opportunities for revenue growth.

We provide a scalable, integrated, and automated platform that simplifies your trade finance profitably.