Tailored Solutions for Sales

Drive sales for your enterprise

At TASConnect, we help multinational corporations streamline sales, optimise value chains, and unlock new revenue. Our Accounts Payable Software, Invoice Management System, and AP Automation Software enhance financial workflows, while Accounts Receivable Software improves cash flow. With our FX Solutions, businesses can manage currency risks and drive global growth.

Explore TASConnect Solutions

Increase sales volume

Gain a competitive advantage in the marketplace by providing your customers with competitive financing options and flexible repayment schedules.

Improve financial planning

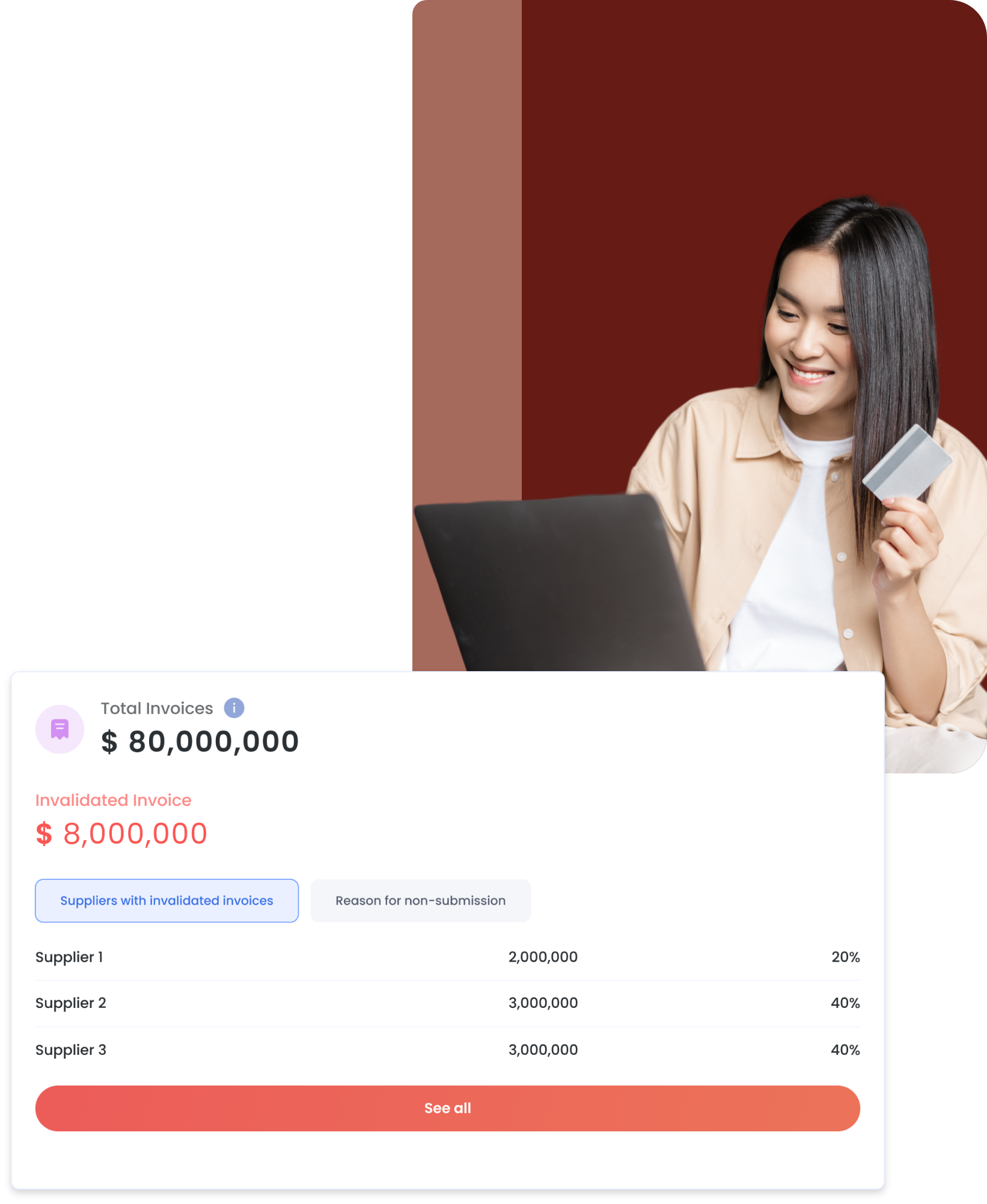

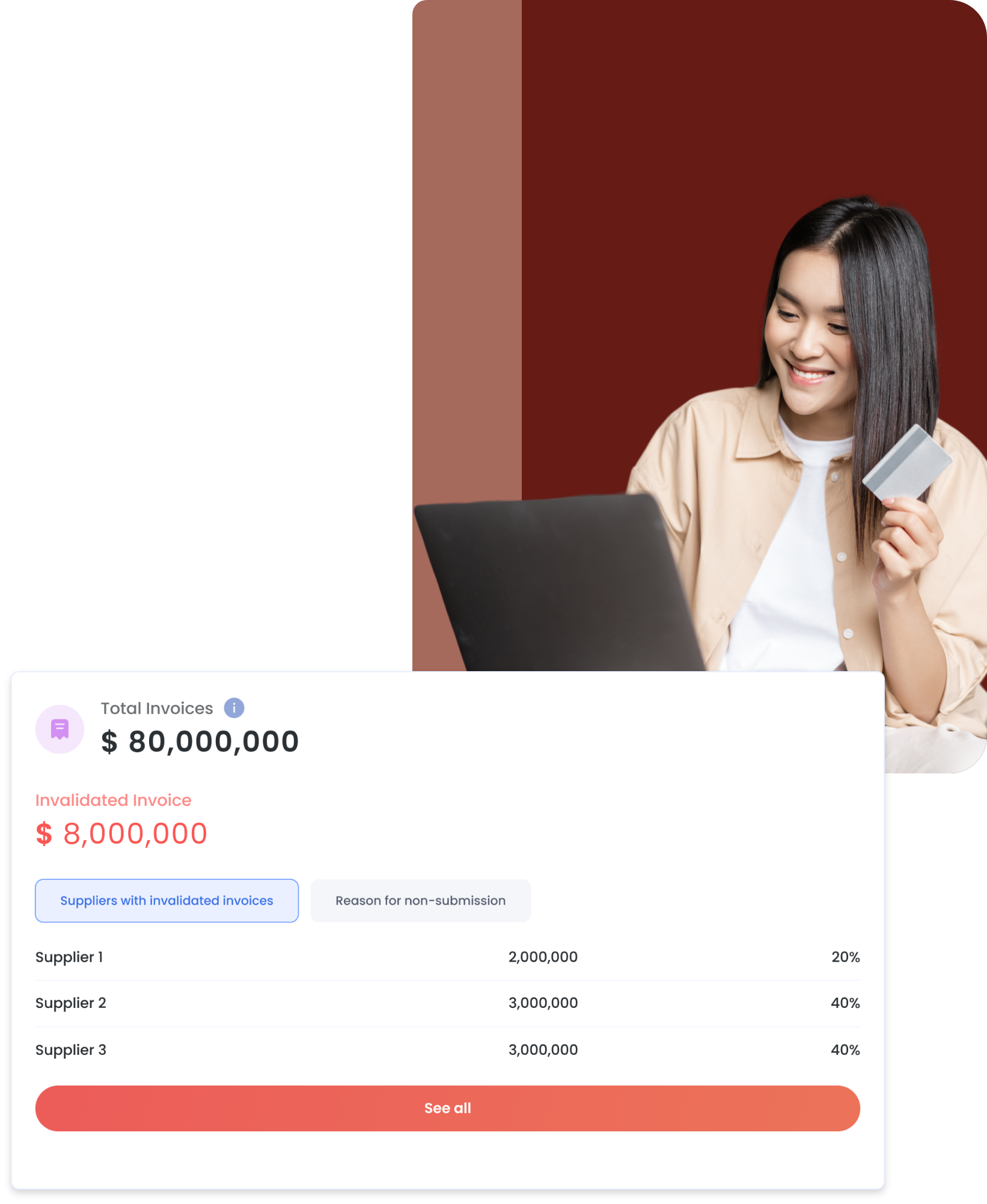

Get comprehensive analytics and visibility on the financing and collection cycle, ensuring the timely settlement of invoices. Our accounts receivable software helps manage outstanding invoices efficiently, reducing overdue payments and improving cash flow.

Generate revenue

Provide flexible financing options to your distributors or resellers to increase sales volumes and improve customer relationships. With our accounts payable software, your business can streamline payments, automate workflows, and optimise cash flow management.

Get paid on time

Reduce payment delays by unlocking working capital digitally. Our invoice management system ensures accurate and timely processing of invoices, reducing manual errors and improving efficiency.

All the tools you need to drive sales

Our distributor finance and FX solutions allow MNCs to build customer loyalty, increase business volumes, and mitigate risks – all in one platform.

Increase sales by 25%*

Get enhanced visibility and control over cash inflows and efficiently manage dealer networks with the TASConnect platform invoice management systems. With access to a panel of financing partners, the platform improves liquidity for dealers, potentially reducing Days Sales Outstanding (DSO) by up to 24% and increasing sales by up to 25%*.

Timely payments and transparent communication through accounts receivable software foster stronger relationships across the supply chain. Additionally, we provide quick access to financing through anchor-led dealer finance solutions, supporting business growth and expansion.

Reduce overdues by 18% and improve access to financing

The advanced analytics that we provide allow for efficient credit risk assessment and management of credit limits across dealer networks, potentially reducing overdues by up to 18%. With an integrated AP automation software, businesses can automate payment approvals, track invoices, and optimise cash management.

Additionally, we provide quick access to financing through anchor-led dealer finance solutions, supporting business growth and expansion.