Pharma

The global pharmaceuticals market reached $1.61 trillion in 2023, fueled by significant R&D investments and advancements in medical technologies. Major pharmaceutical companies like Pfizer, AbbVie, Johnson & Johnson, Merck, and Novartis have significant market share. Asia leads in manufacturing medical devices and generic drugs, while the US and EU focus on specialty drugs.

The COVID-19 pandemic significantly impacted the industry, accelerating the shift towards digital health solutions, remote patient monitoring, and rapid vaccine development. This tested the resilience in the global pharma supply chain.

Post covid, the industry is shifting towards building inventory, diversifying sourcing and building up pandemic preparedness. In addition. Generative AI and biotech advancements are creating new global healthcare companies with requirements that cross borders.

All of this necessitates robust working capital finance solutions.

Issues

High R&D Costs

Pharmaceutical companies allocate around 20% of their revenues to research and development, driving the need for efficient financial management to sustain innovation and growth.

Regulatory Compliance

Ensuring compliance with ESG regulations requires precise and comprehensive reporting, which can be resource-intensive and complex.

Supply Chain Disruptions

The pharmaceutical industry relies on intricate, global supply chains that are prone to disruptions, leading to delays and inefficiencies in drug production and distribution.

Rising Costs

Inflation has significantly increased the costs of labor, raw materials, and transportation, impacting overall drug prices and margins.

Environmental Impact

The pharmaceutical sector contributes significantly to global emissions, facing increasing pressure to comply with evolving environmental regulations and sustainability goals.

TASConnect Features and Advantages

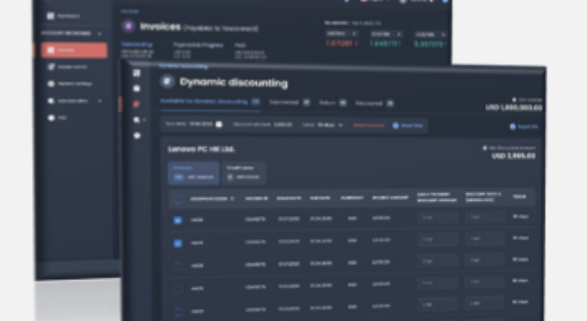

Enhanced Cash Flow Management

TASConnect facilitates orchestration of working capital finance transactions, ensuring improved financial transparency and liquidity management across the pharmaceutical value chain.

Supply Chain Financing

Solutions like pre-shipment financing and dynamic discounting help manage cash flow and ensure liquidity, supporting continuous production and timely delivery of pharmaceuticals.

ESG Compliance

TASConnect provides connectivity with ESG reporting providers for accurate ESG reporting and ESG-linked finance solutions, assisting companies in meeting their sustainability objectives and regulatory requirements.

Risk Management

The TASCSense early warning system detects potential risks within the supply chain, allowing companies to take proactive measures to mitigate disruptions.

Integrated Digital Platform

TASConnect’s centralised platform streamlines financial operations, reducing operational costs and enhancing overall efficiency in managing complex financial workflows.

Cross-Border Payments

TASConnect facilitates seamless FX and cross-border transactions, helping pharmaceutical companies manage international operations smoothly and cost-effectively.