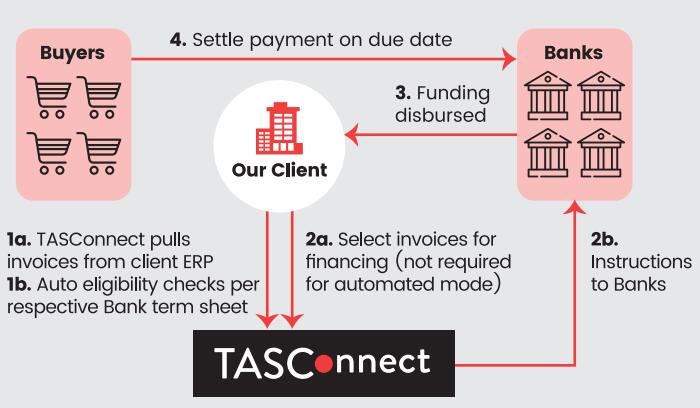

- TASConnect

- For Sellers

- Receivables Finance

Examples of additional features:

Allocation (1 buyer with multiple funders): Client can allocate via TASConnect

Price discovery: closed loop price bidding among funders

Securitization*/distribution via a 3rd party marketplace

Facilitation of field survey & transaction monitoring

- All receivables-based deal structures can be customised on the platform

- Workflows such as Maker-checker, reconciliation, sounding checks etc. can be built-in

- Funder-agnostic, and no funds flow via TASConnect

- Advanced business intelligence is provided

- Full visibility & control of programmes across funders, buyer entities and buyer groups

- Improve working capital ratios and enhance balance sheet efficiency by early conversion of receivables to cash

- Increase liquidity via bank-agnostic funding source & marketplace

- Reduce financing & operating cost through digital price discovery and straight-through-processing

- Mitigate buyer credit risk via non-recourse structure and real-time transaction monitoring

- Enhance efficiencies with Banks for field survey, sounding checks, monitoring etc

- Improve visibility on financing, collections & reconciliation

- Better financing planning and forecasting via advanced business intelligence