Business Challenge

One of India’s largest conglomerates in the electronics manufacturing sector faced growing complexity in managing supplier payments across a vast and diverse vendor ecosystem. As supplier volumes increased, the organization needed a scalable, automated, and capital-efficient solution to strengthen supplier relationships while optimizing internal working capital.

Key Enterprise Pain Points:

- Manual Supplier Payment Management

The operational rollout of the early payment program demanded intensive manual intervention to manage supplier adoption and eligibility tracking, increasing governance and control requirements for procurement and finance.

- Working Capital Optimization

Optimized supplier payment terms and cash flow management are vital for enterprise resilience and competitiveness, enabling working capital solutions to drive market expansion and unlock new growth opportunities.

Enterprise Objectives

- Build a Resilient Supplier Ecosystem:

Enable suppliers to access affordable working capital earlier through structured incentives.

- Generate Returns on Excess Liquidity:

Leverage surplus or trapped cash efficiently to drive yield optimization in a low-rate environment.

The Solution

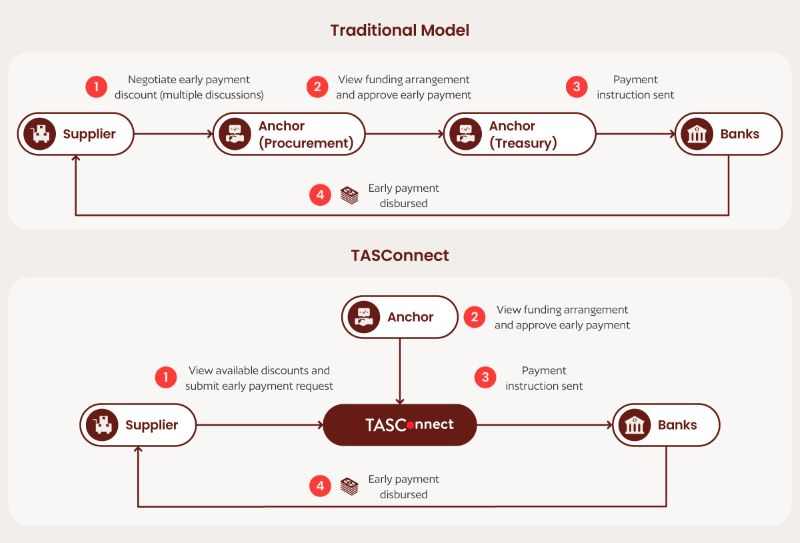

TASConnect has implemented a fully digital, ERP-integrated Early Payment and Supplier Finance platform on AWS Cloud, leveraging its secure, scalable, and highly available infrastructure to automate supplier financing at scale while maintaining strong governance and control.

Platform Capabilities

- Centralized, digital financing workflows processing 10,000+ open invoices daily

- Seamless supplier onboarding and profile management

- Real-time visibility into utilization and limits across multiple banks and financial institutions

- Configurable platform rules tailored to enterprise policies

- Scalable deployment across multiple legal entities and business units

Business Impact & Client Benefits

- Benefits for the Core Enterprise (Buyer)

- Optimized return on excess cash: ~8–10% annualized

- Improved supply chain resilience and supplier loyalty

- Fully automated daily operations through ERP integration

- Complete control over discounting rules, eligibility, and funding logic

- Scalable solution supporting growth across geographies and entities

- Benefits for Suppliers (Vendors)

- Quick qualification with no collateral or financial statements required

- Faster access to cash, improving liquidity and financial planning

- Reduction in accounts receivable cycle by an average of ~25 days

- Lower overall cost of capital

- Simple, intuitive platform enabling on-demand cash access

Outcome

The successful implementation of the Supplier Finance and Early Payment solution significantly improved working capital efficiency strengthened the supplier ecosystem and delivered measurable financial returns for the enterprise.

As a result of this success, the client mandated TASConnect to further enhance their Supply Chain Finance (SCF) program by introducing the Dynamic Discounting (DD) module, expanding the value delivered across the supplier network.

Conclusion

This case study demonstrates how a technology-driven Early Payment and Supplier Finance solution can help large enterprises in the electronics manufacturing sector optimize working capital, unlock liquidity, and build a resilient, future-ready supply chain.