Introduction: Shifting from Efficiency to Strategic Liquidity

Dynamic discounting is increasingly gaining traction as working capital management evolves. Traditionally seen as a tactical tool for optimizing accounts payable, dynamic discounting is transforming into a strategic mechanism that enables companies to strategically deploy their cash, improve supplier liquidity, and strengthen resilience across supply chains in an environment where liquidity is no longer cheap. As we look toward 2026, finance leaders should pay attention to several forces shaping this evolution, from macroeconomic shifts to digital technologies and integrated working capital strategies.

Understanding Dynamic Discounting Today

Dynamic discounting allows buyers to offer suppliers early payment of approved invoices in exchange for a discount that varies depending on how early the payment is made. This model differs from static discount terms by enabling real time flexibility: the earlier the payment, the larger the discount, and the decision is made at an invoice-level rather than based on a fixed payment schedule.

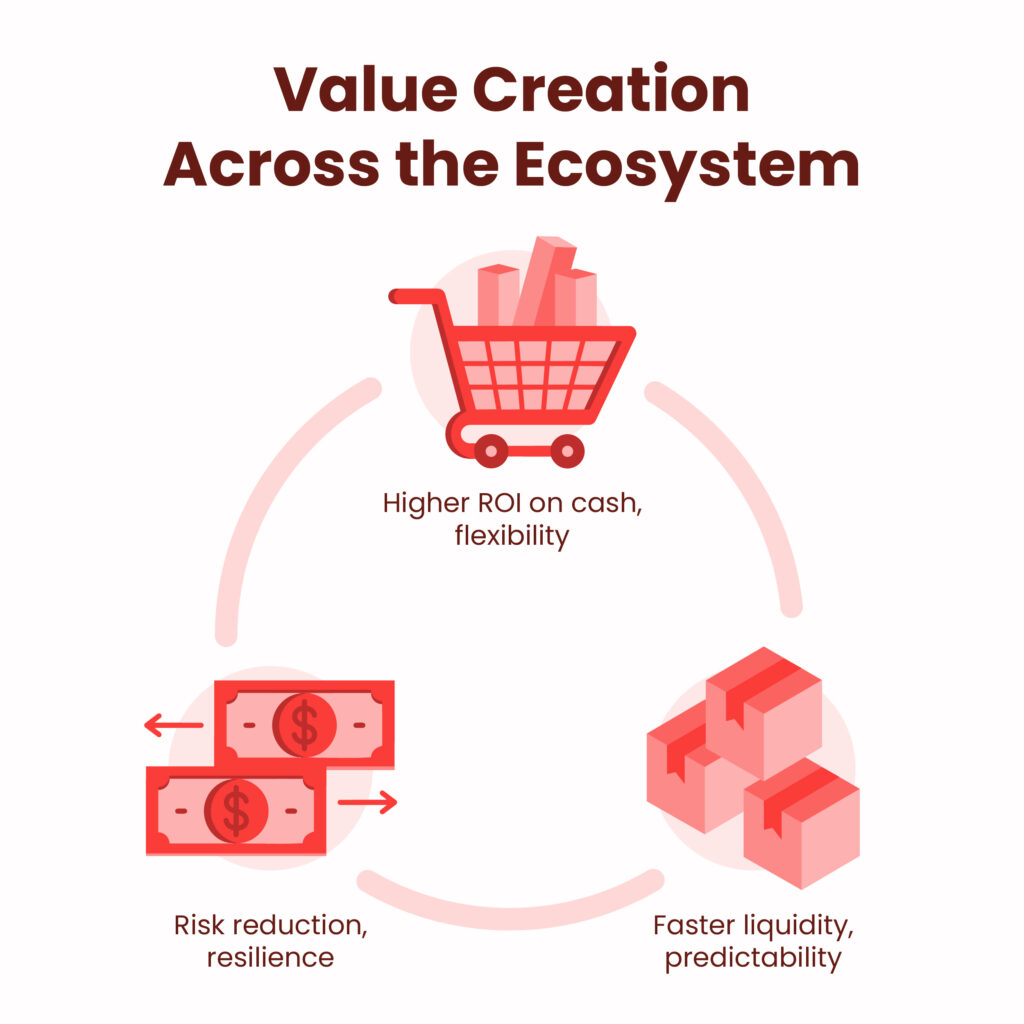

This structure benefits buyers by converting excess liquidity into higher, low risk returns, while suppliers enjoy improved cash flow without resorting to high cost external financing.

- Working Capital Management Is Becoming More Strategic

Recent industry insights show that working capital optimization has moved from a back office finance chore to a core strategic priority. McKinsey highlights the substantial benefits of improving working capital performance, noting that companies can unlock vast amounts of liquidity, often tied up in receivables, payables, and inventory, without increasing sales or reducing costs.1 Effective management of working capital, including innovative payment terms, can generate significant cash quickly and support broader transformation initiatives. McKinsey & Company

For dynamic discounting specifically, this means organizations are now evaluating not just discount yields, but how the approach fits into a holistic cash strategy that includes forecasting, liquidity planning, and broader supply chain risk management.

- Digital Integration and Real Time Decisioning Are Essential

Digital transformation is a major driver of dynamic discounting adoption. As finance, procurement, and treasury systems become more interconnected, real time visibility across invoices, cash positions, and supplier needs enables faster and smarter decisions.

Rather than treating dynamic discounting as a separate program, leading organizations are embedding it into their broader procurement and cash management workflows. This integration allows buyers to evaluate early payment opportunities within existing tools and dashboards, turning working capital optimization into a live, operational capability rather than an isolated finance process.

- Supply Chain Finance Trends Are Broadening the Context

Industry observations from supply chain finance forums show that dynamic discounting is part of a broader supply chain finance evolution. Companies are increasingly combining multiple financing strategies, including dynamic discounting, reverse factoring, and payables finance, to address liquidity needs across extended supplier networks.

The future of working capital requires solutions that not only improve a company’s internal metrics but also consider supplier liquidity needs across multiple tiers of the supply chain, expanding the concept of resilience beyond a single buyer or supplier relationship.

Dynamic discounting, with its flexibility and ease of automation, fits well into this ecosystem and is expected to grow as part of comprehensive supply chain finance strategies.

- Liquidity Is Now a Priced Asset: Not an Assumed One

Following several years of tightening monetary conditions and elevated cost of capital, liquidity is increasingly treated as a priced and managed asset rather than a default resource. Industry commentary notes that organizations are re engineering their cash conversion cycles to reflect this new reality, deploying methods such as dynamic discounting programmes and blending external funding sources to preserve optionality.

This shift means finance leaders must carefully balance the benefits of capturing early payment discounts with broader cash needs and strategic investments. It also elevates dynamic discounting from a “nice to have” optimization tool to a cash deployment strategy that can enhance overall financial resilience, especially in countries with strict regulations around the movement of hard currencies, creating a trapped cash situation for global players.

- Supplier Relationships and Ecosystem Health Matter More Than Ever

Dynamic discounting also plays a role in strengthening supplier relationships. By offering suppliers greater control over when they receive payment, buyers can reinforce trust and collaboration, especially among small and medium sized suppliers that face higher borrowing costs and liquidity constraints. gep.com

In an environment where supply chain disruptions have become more common, ensuring that suppliers have access to dependable liquidity contributes to operational continuity and reduces the risk of cascading failures across the supply network.

Conclusion: Dynamic Discounting as a Strategic Building Block in 2026

Looking toward 2026, dynamic discounting will no longer be viewed as a tactical source of discounts. Instead, it is becoming a strategic lever within modern working capital frameworks, one that enables finance leaders to deploy cash purposefully, strengthen supplier networks, and integrate deep liquidity management into daily operations.

By embracing digital integration, broadening strategic fit with supply chain finance solutions, and treating liquidity as a managed asset, organizations can leverage dynamic discounting in ways that support not only financial performance but also broader enterprise resilience in a dynamic global environment.

References

1Working capital optimization and its strategic importance — McKinsey & Company.