Copyright © 2024 TASConnect All rights reserved

For Enterprise Sellers

Enhance your cashflows and distribution network growth

A recalibration of the sell-side of your value chain is imperative to address economic instabilities and geopolitical issues. Improving cashflows, strengthening balance sheets and building long-term organic growth have become clear priority areas for corporates to navigate through these uncertainties.

Adoption of innovative digital solutions unlocks opportunities to reinforce the financial strength of your distributor networks. It allows you to accelerate sales growth and build channel loyalty while maintaining your own liquidity.

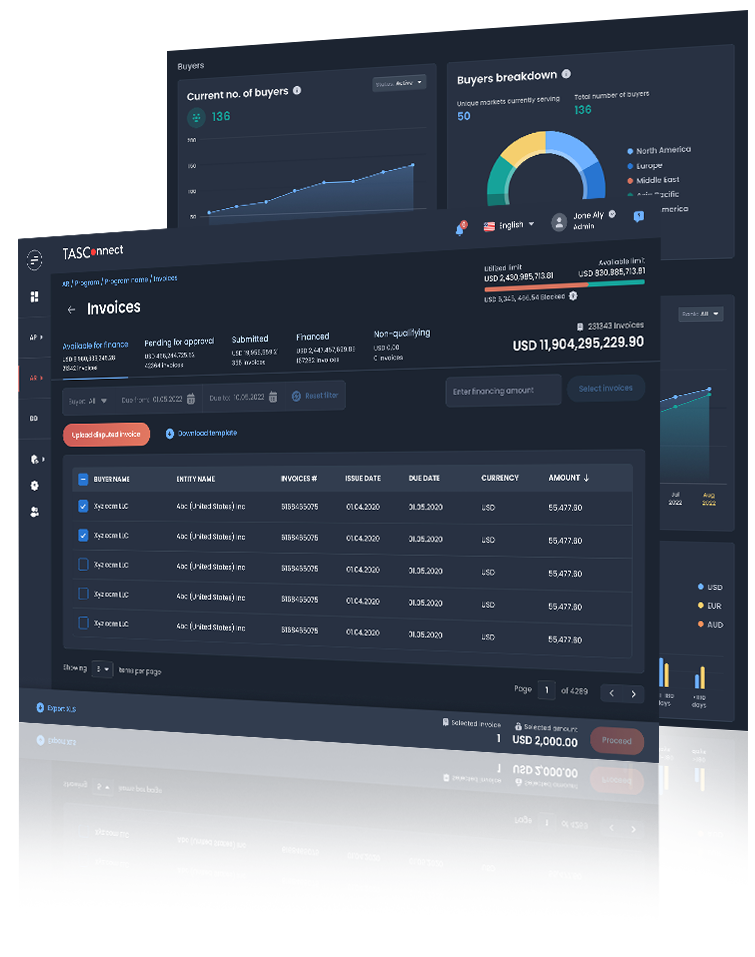

In addition, such solutions provide real-time visibility and advanced business analytics of your buyer portfolio. You are therefore better equipped to make more accurate decisions and conduct the thorough assessments of ecosystem health.

TASConnect’s integrated, customisable and multi-funder digital solutions for accounts receivable enable corporates to enhance cashflow, boost sales and better manage risks in the distribution network.

Experience a range of benefits

For you – anchor seller

Bolster your financials

- Increasing liquidity and cashflow via bank-agnostic approach

- Improving working capital cycle

- Enabling diversified funding sources

For you - anchor buyer

Boost your sales ecosystem

- Ensuring customer reliability and loyalty

- Achieving balance sheet efficiency

- Simplifying payment collection process

For your buyers / distributors

- Assured, steady financing via programme approach

- Reduced operating cost

- Simplified onboarding, submission and payment processes

- Enhanced efficiencies and visibility

Insights

A platform fine-tuned for the sell-side

The TASConnect platform is the result of in-depth research among corporate sellers, keeping in mind their focus areas and understanding ways to optimise their sales practices and finances.

Check out how industry experts view working capital solutions in optimising accounts receivable here:

Point-of-view series of Frictionless Finance prepared by PwC Singapore

LEADERSHIP VIEW

Which supply-chain financing solutions can help your company optimise accounts payable and procurement practices?

AI/ML led business intelligence

83 %

End-to-end digitalisation of workflow

78 %

Automated sounding checks with banks

75 %

Invoice level reporting & reconciliation

70 %

Provision of distributor financing

65 %

ESG traceability across value chains

48 %

Increasing liquidity and improving cashflow for your company

75 %

Having flexibility of funding sources from multiple financial institutions

53 %

Reducing DSO (Days Sales Outstanding)

35 %

Source: Frictionless Finance - Technology Sector

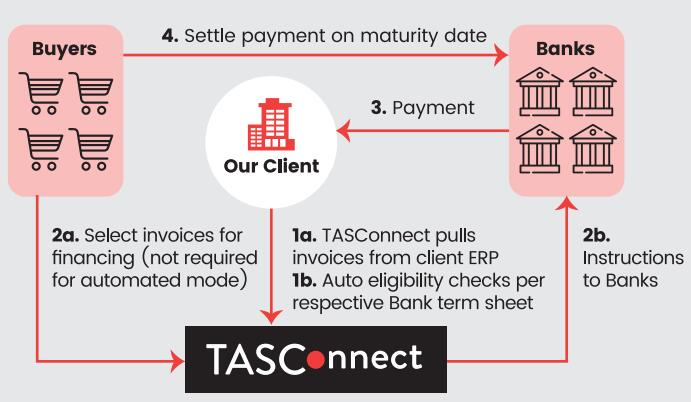

How it works

A selection of key features

- All receivables-based deal structures customisable on the platform

- Choice of multiple funders

- Option to enable distributor finance workflow

- Possibilities of offering integrated payment checkout and digital FX through partnership