Drive liquidity and supplier trust with our payables solution

Optimise working capital, strengthen supplier relationships, and enable sustainable growth. TASConnect combines client-first technology, smart data insights, and banking expertise to unlock liquidity fast and delivering measurable results from day one.

Explore TASConnect Solutions

Why TASConnect for Payables?

Unlock liquidity and strengthen supplier relationships with flexible early payment options via payables financing or dynamic discounting. Powered by client-first technology, smart insights, and banking expertise, TASConnect delivers results from day one while scaling efficiently without straining resources. Built for speed and easy adoption, our platform helps you support most of your suppliers within the first year, boosting cash flow and keeping your supply chain moving smoothly.

Why TASConnect for Payables?

Unlock liquidity and strengthen supplier relationships with flexible early payment options via payables financing or dynamic discounting. Powered by client-first technology, smart insights, and banking expertise, TASConnect delivers results from day one while scaling efficiently without straining resources. Built for speed and easy adoption, our platform helps you support most of your suppliers within the first year, boosting cash flow and keeping your supply chain moving smoothly.

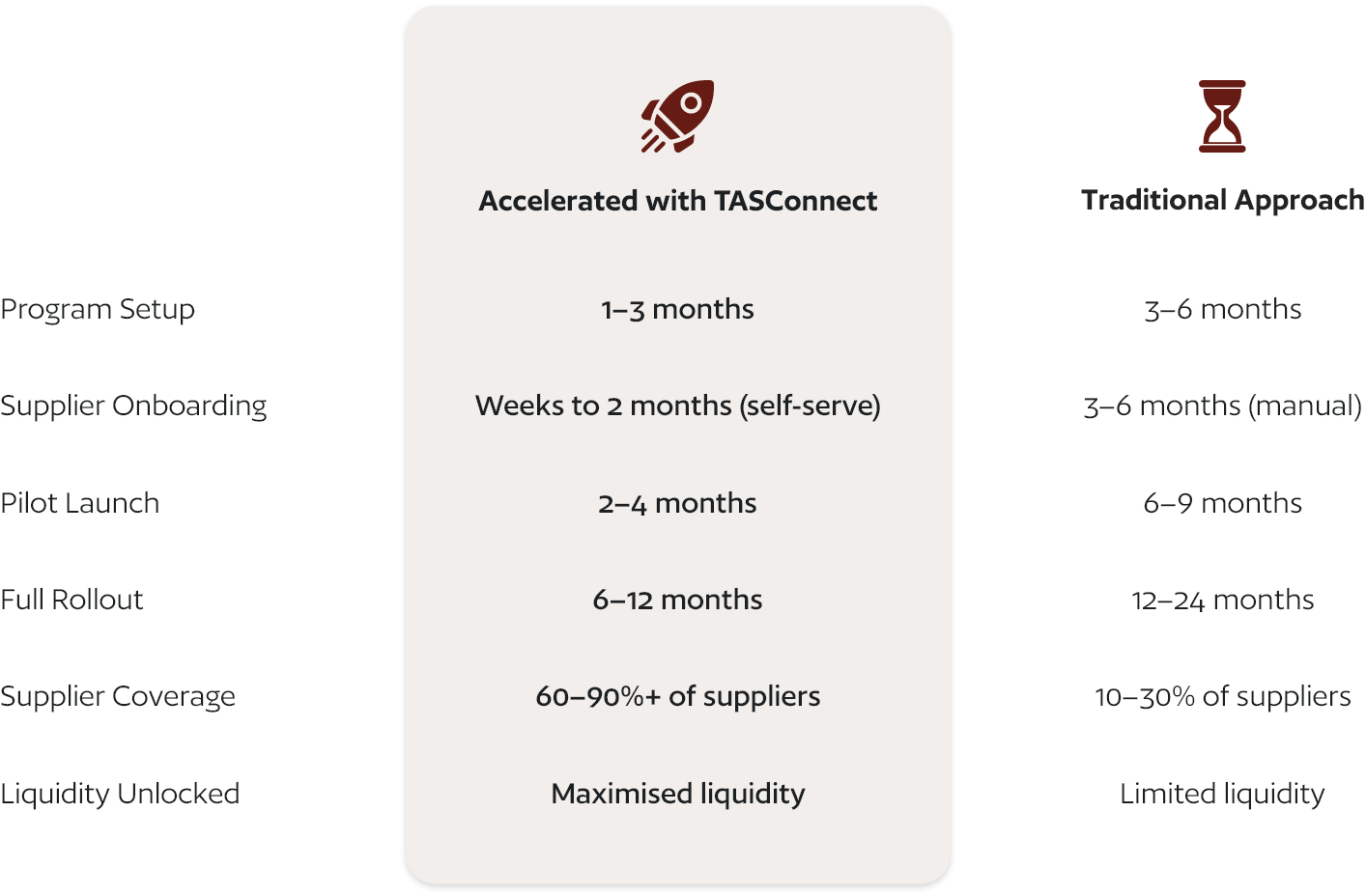

Go live in as little as 4 weeks

Cut months off traditional timelines with TASConnect’s digital platform, driving rapid supplier adoption and maximised liquidity

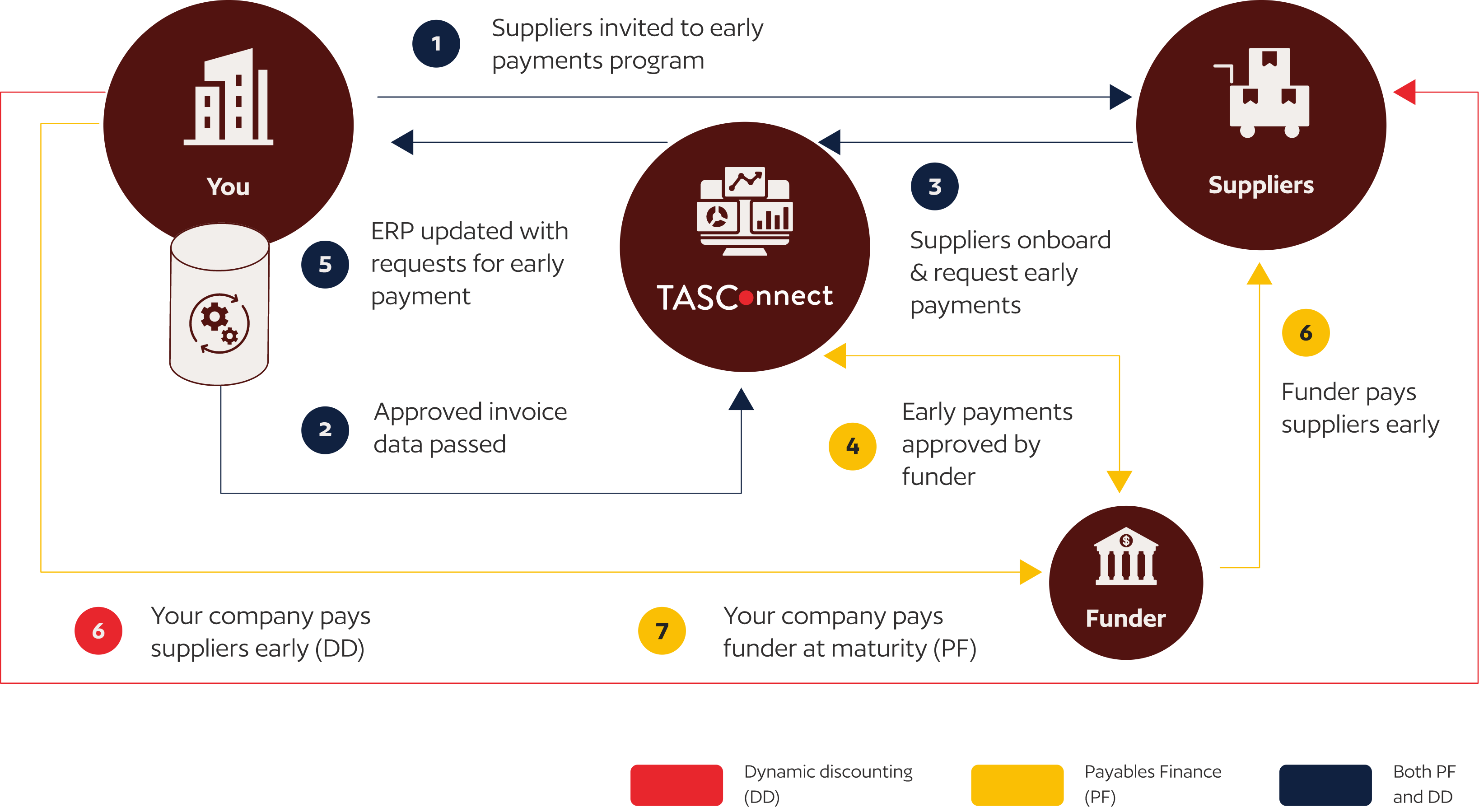

How it works

Our Features

Powering smarter, faster supply chain finance.

Multi-Funder Flexibility

Use your own capital or choose from a network of banking partners without integration hassles. All funders connect seamlessly through the TASConnect platform.

Credit Note Safeguards

Automatically offset credit notes against upcoming payments (FIFO) or based on specific dates when unresolved credits are detected ensuring accurate disbursement.

Seamless ERP Integration

Automate remittance updates and reconciliations directly within your ERP system. Eliminate manual work while maintaining complete data accuracy and audit integrity.

Supplier Self-Onboarding

Empower suppliers to register for early payment programs with just a few clicks. Provide full transaction visibility, including invoice-level details like amounts, discounts, and credit offsets.

Dynamic Funding

Set dynamic funding preferences that adjust in real time based on available cash and margin targets. Instantly modify settings to align with shifting liquidity needs.

Cash Flow Intelligence

Leverage real-time analytics and network insights, powered by machine learning, to monitor impact, fine-tune performance, and plan future working capital strategies.

Hear from our client

“TASConnect has been a valuable partner in supporting our distributors with seamless access to competitive financing from leading financial institutions. By improving liquidity and providing essential working capital, our distributors can efficiently manage inventory, leverage bulk purchase incentives, and strengthen their relationship with Syngenta. This has enabled a more resilient and sustainable supply chain, benefiting both our distributors and our business.”

“Optimising the precision of supply chain management, balancing business expansion opportunities with risk management, and enhancing real-time insights into overseas markets and industry trends are all key considerations in our globalisation process. TASConnect, with its international perspective and customer-centric approach, has provided us with multi-dimensional insights, an effective data analytics framework, and customised service content that meets our complex needs across our sales, risk management, finance control, treasury and more functions.”

Yang Jinpei

Chief Financial Officer of YOFC

“TASConnect has provided us with a digitalised and ecosystem-driven cross-border supply chain finance platform along with professional and meticulous support at every stage, including demand analysis, solution design, internal alignment, and customized planning. We look forward to leveraging TASConnect’s global presence and expertise to co-create industry-leading, intelligent, and international supply chain solutions.”

Gao Minghui

Chairman of Protus Group

“TASConnect has been instrumental in our business growth, connecting us with multiple financing providers and government agencies to secure vital trade financing. Their one-stop platform simplifies access to financing limits, invoice tracking, and facility monitoring—freeing up resources for value creation.

We also extend our gratitude to Agrobank, recommended by TASConnect as the go-to bank for the agricultural sector. Initially skeptical, we soon realised Agrobank’s deep industry knowledge and unwavering support. TASConnect truly understands what growing SMEs need.”

Loh Jen Min

Finance Director

“TASConnect helped us transform & fully automate our previously manual supply chain finance processes. The platform is customised to integrate all our financing banks and replicate our own workflows. Our Treasury function is now empowered with end-to-end visibility and control, all via one single platform.”

Hugh Wu

Global Treasury Head, Lenovo

Download our Early Payments Brochure

Keep a copy of our brochure to see how early payment solutions like payables financing can benefit your business and suppliers.