One of the main hurdles to supply chain financing is the complex and fragmented nature of the supply chain itself, especially for global organisations. For instance, a tech multinational firm with a USD 20 bn annual turnover would typically have at least 200 suppliers spread across over 15 countries, each banking with a least a handful of local financial institutions.

Furthermore, global trade processes and systems lag considerably in digitalisation compared to other treasury and working capital processes. For instance, in most countries, international trade documents still need to be physically sighted due to regulatory and legal constraints. This poses a formidable challenge to achieving scale through a fully end-to-end digitalisation process in areas such as supply chain financing.

In order to achieve true end-to-end digitalisation, it is important to not only converge all relevant functionalities and processes onto a single platform, but also attain a seamless and smooth workflow between disparate functionalities and processes through interoperatibility. Taking a look at the TASConnect platform, all activities necessary to facilitate supplier financing can take place on a single digital platform. In fact, we think it can offer much more than that. A one-stop digital platform can pave the way for interoperability, bringing a range of benefits like efficiency, visibility as well as transparency in regulatory compliance.

As a result, enterprises will now be able to scale the depth and breadth of financing programs to include medium and smaller suppliers, which was previously not possible due to manual processes.

Interoperability is the ability for different information systems, devices or applications to seamlessly communicate, exchange data and use the information, regardless of each of their underlying technologies. We highlight below some examples of interoperability in an anchor firm’s digital platform.

Onboarding of suppliers

The on-boarding of suppliers to a financing programme is often a laborious and manual operation involving the supplier, the anchor firm, their respective banks and mountains of documents. Yet, this is a critical part of any supply chain finance programme, as the supplier needs to provide evidence of its business viability and financial credibility to gain access to the anchor’s bank financing.

However, with a digital platform, the onboarding process can occur at speed if the respective banks and suppliers are already on the anchor’s digital platform or can be brought onto the platform. With the latter, for instance, an anchor firm can send out a blast email via its digital platform to its top 50 to 100 suppliers with a link that connects the onboarding process with their choice of banks, thus allowing innumerable suppliers to be onboarded simultaneously.

The know-your-customers (KYC) process to vet the supplier can also be conducted seamlessly as all the necessary information required by the anchor firm’s bank are readily available on the platform. More importantly, none of the stakeholders need to change their processes to facilitate this interoperability. This is a critical point if one is to gain their support for the programme.

Data driven underwriting

Manual underwriting usually involves extensive paperwork and time-consuming data collection. Moreover, these often lead to rather subjective risk assessments, especially for smaller ticket sizes, which can be avoided through a programatic approach.

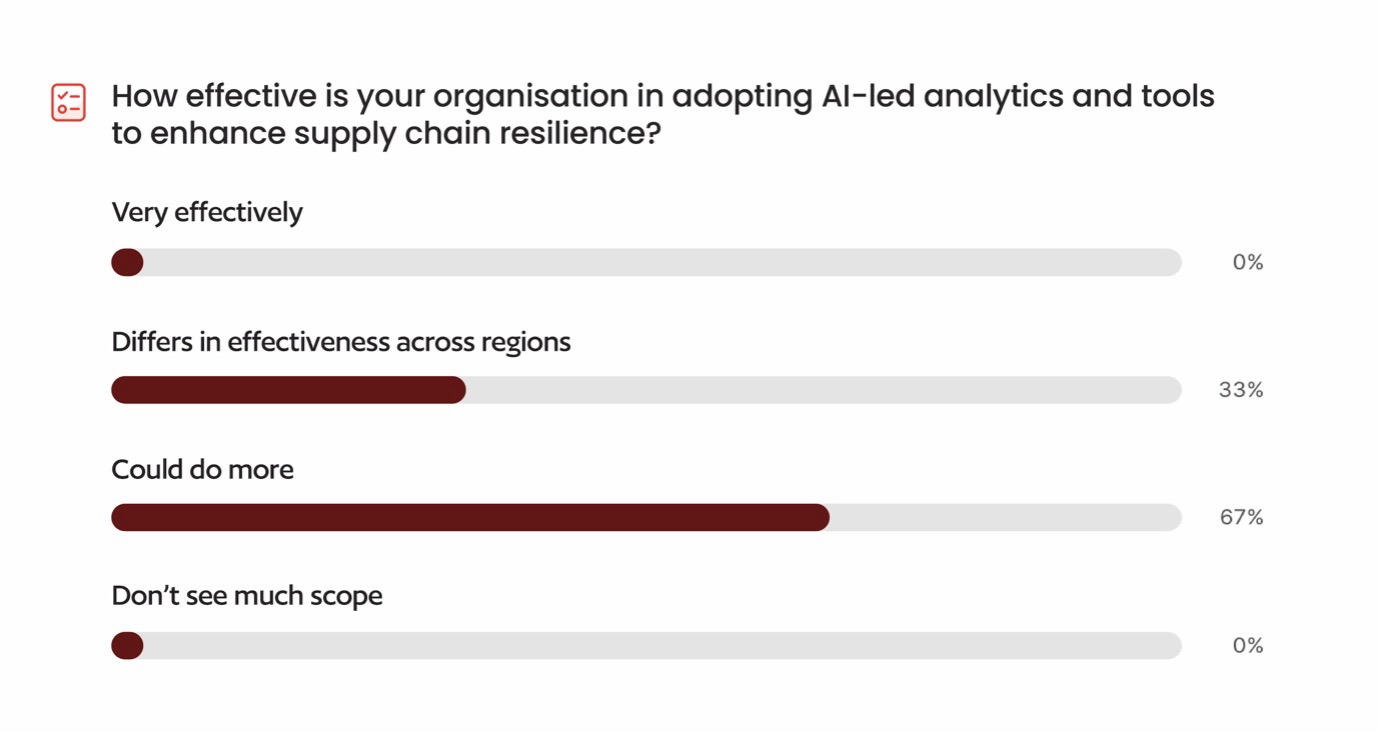

But with the ‘platformisation’ of data, it is now possible for banks and financial intermediaries to underwrite pre-shipment financing risk using AI/ML driven data analytics on a single digital platform.

This data-driven approach not only improves the underwriting efficiency and reduces manual processes, but also helps banks optimize risk management, thus enhancing their underwriting decisions.

ESG compliance of suppliers

The days of incorporating a token paragraph on environmental, societal and governance awareness in a company’s policies have long passed, especially for global listed MNCs. These days, large multinational public companies are not only required to adopt strict ESG compliance and are rated accordingly, but the onus has gone beyond their immediate operations to include that of their suppliers. Global MNCs now need to ensure and demonstrate to regulators and investors that their supply chains are ESG compliant.

One of the ways this can be demonstrated is through interoperability within a digital supply chain platform. Most banks incorporate ESG criteria in their lending activities, which guides the appropriate interest rates based on a borrower’s level of ESG compliance. Meanwhile, there are data firms which specialise in collecting and scoring ESG data profiles of companies, including suppliers. STACS, a partner of TASConnect, is an example of such.

In this instance, adopting a single digital platform provides an avenue for banks to vet the ESG profile of the anchor firm’s suppliers when setting the relevant interest rates for supplier financing. The action also provides an audit trail to substantiate the anchor firm’s ESG compliance in its supply chain. The process highlights the interoperability benefit.

Visibility on physical goods

The ability for a CFO to gain visibility of the supply chain is invaluable as it facilitates timely decision-making. By using physical supply chain in the service of financial supply chain, digitalisation has now made it possible to provide relevant parties (like banks, FIs and large anchors) unprecedented visibility of the physical movement of goods, especially, in the pre-shipment stage.

This visibility and transparency can help to enhance the banks and FIs’ understanding of the pre-shipment process, enabling them to better underwrite credit risk in the pre-shipment stage of the working capital cycle.

Sentiment analysis using AI models

Digital platforms can be adapted to include the risk monitoring of supply chain risk sentiment. Our partner TAS Sense utilizes AI models to scan over 70,000 websites to produce risk assessment scores on suppliers. This means that with a single digital platform at TASConnect, an anchor can monitor the risks of its top 50 or 100 suppliers.

By mining data and websites to spot potential risks to the supply chain such as natural disasters, strikes or fire, a digital platform can provide timely analysis on the supply chain risk sentiment, allowing CFOs the opportunity to make timely decisions to adjust and realign their procurement strategies, if necessary. These tools also allow banks and FIs to proactively monitor portfolio risk.

The ability to substantially mitigate performance risk highlights the adage – ‘Forewarned is Forearmed’.